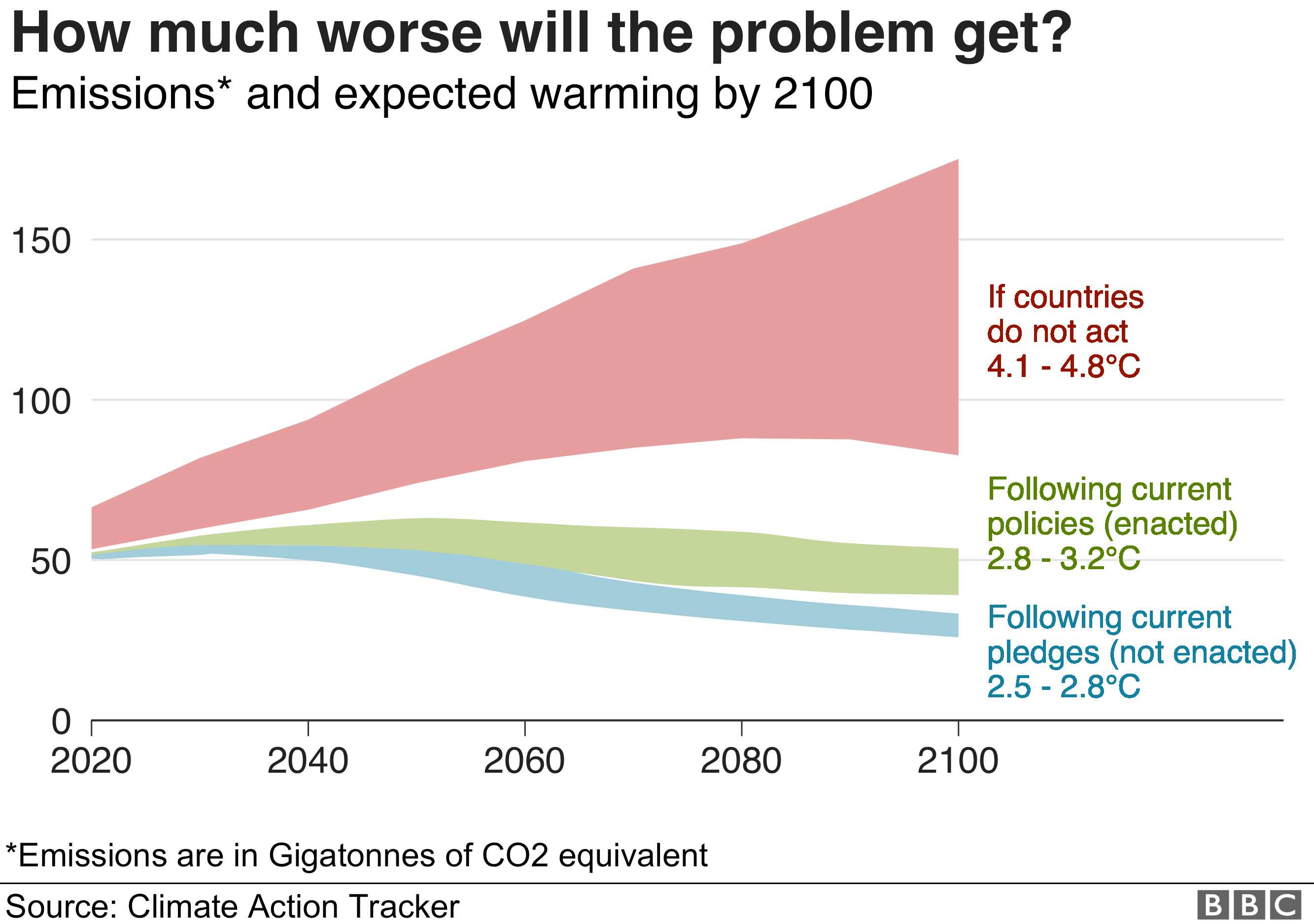

Climate change, a concept deemed an alarmist theory thirty years ago, is now forefront in policy construction for governments worldwide where climate change is a classic market failure. This being as consumers and industries make decisions that are environmentally harmful because the benefits from this behavior (e.g. car usage) outweigh the costs (e.g. price of fuel or renewable energy source).

Source: https://www.bbc.com/news/science-environment-46384067

Despite increased urgency to address the problems of climate change, deep divisions still exist over what form climate change measures should take. The following goes over three of the most popular environmental policy measures to tackle climate change: carbon taxes, tech-focused innovation and cap-and-trade.

What are the arguments for these measures?

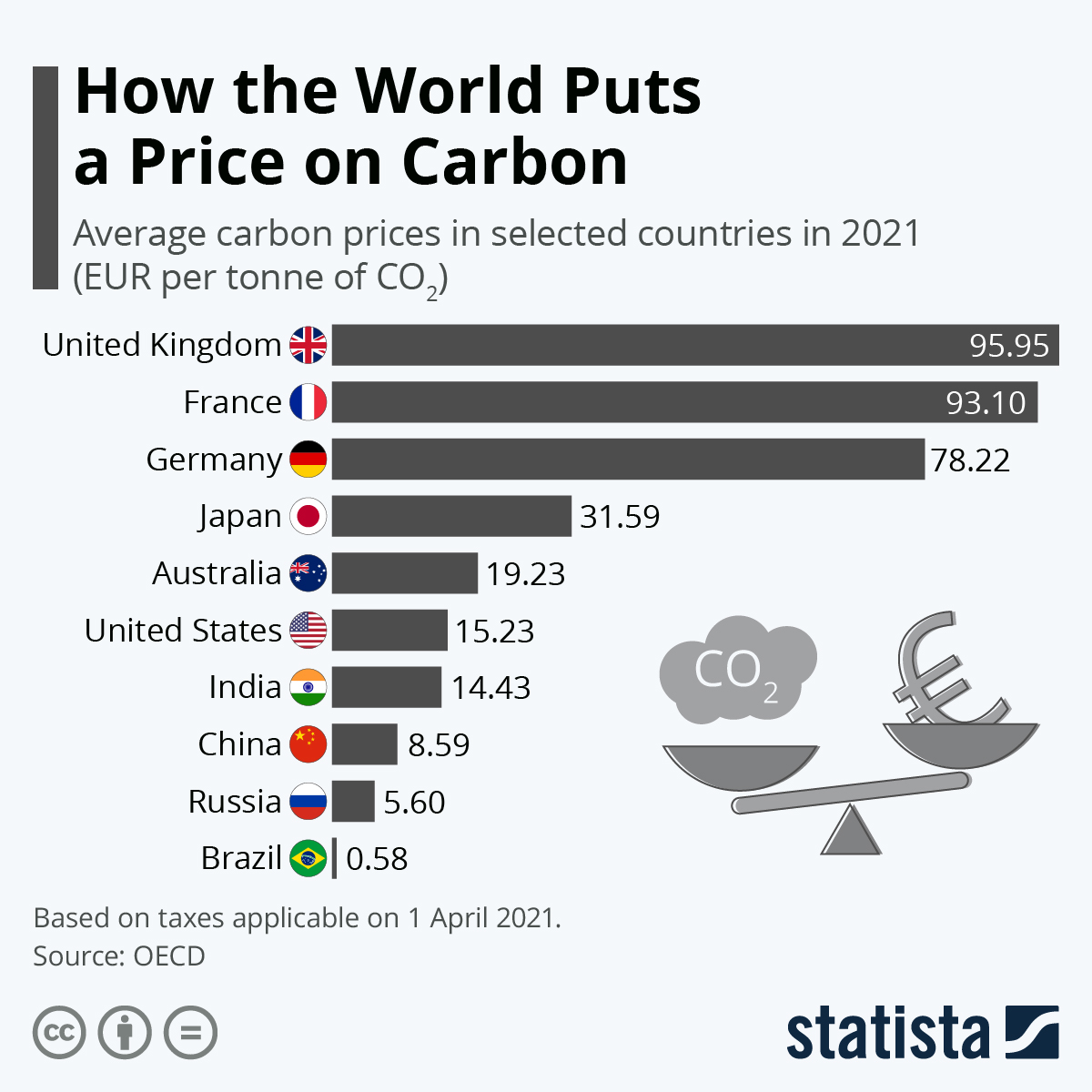

Deemed as a neoclassical economic measure – i.e. primary focus on supply and demand as the driving forces behind production, pricing and consumption of goods and services – carbon taxes are a popular measure amongst economists. Carbon taxes are a type of Pigouvian tax – taxes designed to primarily change behavior, rather than to just raise revenue, and capture all the negative externalities it imposes.

The government setting the carbon tax attempts to make sure the private cost of the polluting activity is equal to the social cost, forming effective compensation. A higher carbon tax is argued to create dynamic efficiency – to influence business and consumers to search for alternatives and find new ways to reduce emissions – as well as generating revenue for the government. The resulting revenues can then be reinvested into the economy through infrastructure and R&D spending.

Simply put, carbon taxes increase the cost of polluting via a demand-side effect or technological substitution effect, i.e. lowering the overall demand. It is argued that a carbon tax-focused environmental policy creates revenues that offset any potential negative effects and is very popular in countries like Sweden who have the highest carbon tax in the world at €110/US$123 per ton of fossil CO2 emitted where is argued to have not hampered Sweden’s economic growth. Carbon taxes are easy to implement and are transparent which explain its popularity.

Source: https://www.statista.com/chart/17095/highest-carbon-taxes-in-the-world/

At a basic level, introduced in the 1970s by John Holdren and in 1974 by Paul Elrich, the relationship between environmental impact can be described by the following equation: I = PCT where I denotes environmental impact, P denotes the population, C denotes consumption and T denotes technology. Where population and consumption increase, if technology remains constant, this results in greater environmental impacts. This highlights the need for sufficient technological improvement to offset these effects.

If the government heavily invests in technology as the focus of its environmental policy, this would, in theory, not only lead to the development of sufficient technological improvement but also would reduce the cost of businesses and consumers to use such technology. Such policies could easily be financed by higher taxes on the wealthy as opposed to a traditional carbon tax.

Cap-and-trade is a popular policy and forms the cornerstone of the European Union’s Emission Trading Scheme (ETS) as well as within various states within the US. Cap-and-trade is a market-based environmental policy which has the primary purpose to place a limit on harmful pollutants across a given industry or the entire economy.

Source: https://www.investigate-europe.eu/en/2020/eu-emissions-trading-scheme-explained/

Economists argue that policies like carbon taxes assume that a government is certain of the price of emissions. However, cap-and-trade may be favored if governments are more certain about the volume of emissions and not the price. One of the economic advantages of cap-and-trade is that by allowing the trading of polluting permits, businesses with high abatement costs – the cost to remove or reduce environmental damages – would have incentives to bid higher for these permits. Being market-based is also popular politically, as opposed to tax-based measures.

So, what are the arguments against?

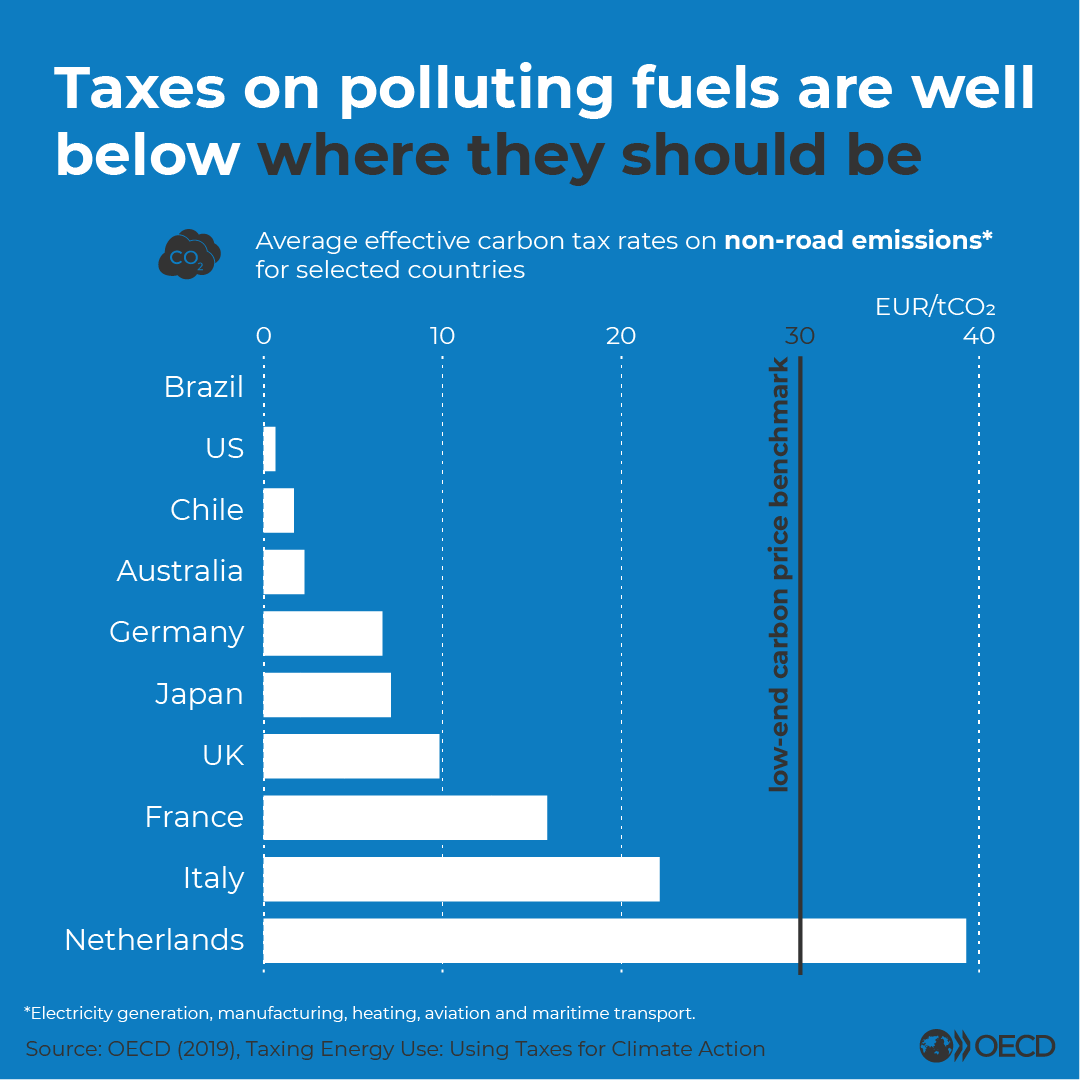

• Carbon taxes can stunt the economy or do little to help the environment if set at the wrong level

One of the biggest critiques of carbon taxes is that, typically if taken by itself, they impose a long-term drag on the economy. Especially if set too high, carbon taxes are argued to decrease the overall level of economic activity and may encourage companies to relocate abroad or pollute in secret even if tax revenues are invested back into the economy. Even companies that produce few pollutants still may feel an effect as their inputs in production, created by other companies, do pollute. For those that do pollute, the time taken to change industrial behavior often takes a long time, no matter how high the carbon tax is.

Source: http://www.oecd.org/ctp/taxing-energy-use-efde7a25-en.htm

If a carbon tax is set too low, this also may not have much of an effect on mitigating climate change. As of today, many countries still have carbon taxes set too low. This is partially due to the difficulty in matching carbon pricing to environmental damages. Furthermore, higher taxes are often followed by price hikes which can, in turn, exacerbate issues of inequality which can be politically damaging. This is was seen famously in France with the gilets jaunes protests of 2018/19 as well as with protests in numerous other countries. To avoid worsening inequality, countries may instead tax the wealthy and reinvest in innovating renewable technologies which brings up the following issue.

• Using tax revenues to invest into technological production would take too long

Taxing the wealthy in order to invest the money back for innovating clean energy technologies, is in its essence a subsidy. According to industry experts and some economists, without changing industry behavior to shift towards environmentally-friendly production methods and outputs, this would impose additional costs to the consumer in the short-term.

As clean and renewable energy is still a small part of the overall energy consumption, and as such technologies would take time to install, investing in technologies through tax revenues is a long-term strategy. If the aim is to meet the Paris Agreements, this method may not meet such targets in time. This is also ignoring the fact that higher wealth taxes remain a political challenge in many countries. So, if not carbon taxes or tech-intensive innovation, what about cap-and-trade?

• Cap-and-trade is too confusing and difficult to implement effectively

Cap-and-trade is an issue that has inspired countless academic and industrial studies on how to set the cap of emissions and the appropriate price most effectively. This leads to the first criticism that cap-and-trade is not that understandable. As stated by John Kerry in 2009, “I don’t know what ‘cap and trade’ means. I don’t think the average American does.”

To complicate this issue, compared with straightforward taxation, cap-and-trade also has issues of transparency, the potential of interference from special interests and corruption in order to benefit certain industries over others. The European Union, who runs the world’s largest cap-and-trade system has been repeatedly challenged with allegations of corruption including re-sale and misreporting of carbon offsets including sophisticated computer hacking of national carbon emission registries.

As with the discussion on taxation, cap-and-trade is prone to the same criticism that it takes too long to tackle climate change issues. Due to the complicated processes of setting up cap-and-trade systems, political and legal wrangling as well as lengthy negotiations, the benefits of cap-and-trade would take a while to realize. For California, concessions which crowd out public sector investment have, in 2019, reported to have seen oil and gas companies polluting more than when cap-and-trade was first started.

So, what's the point?

Now, this barely covers the entire story but rather is a summary of some of the most important points regarding three popular policy instruments. A common criticism is that these policies would take a long time to effect meaningful change. However, these are, in reality, not implemented in isolation. These three policies discussed are only a few in an exhaustive list of options, such as, enhanced regulations, product standards, information campaigns, cap-and-dividend and policies similar to the Green New Deal in the US (future blog post). Whatever the decision, the challenges posed by climate change and pollution is something governments need to take a lot more seriously.

No comments:

Post a Comment